There are factors that affect your monthly car payment including your ability to pay, your credit score, down payment, length of loan term, etc. You must be aware of these factors before you decide on buying a new vehicle. A simple auto loan payment calculator can determine how much money you can save on your monthly car payments. There are also auto loan calculators for borrowers that help determine the amount of loan you need based on your current repaying finances.

The total interest rate of your loan is one of the most important factors that affect your monthly car payment goes toward. A good auto loan payment calculator can determine the amount of interest rate that you can qualify for. If you choose a fixed interest rate you are assured of a fixed interest rate until the full amount is paid back. A variable rate would mean that the total interest rate can change anytime, thus you are not secured to any specific rate. There are many websites that offer auto loan calculators for different purposes such as student loan and mortgages, used by employers to compute insurance rates, etc.

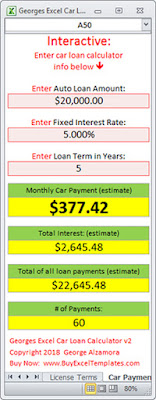

You can use the monthly car loan calculator to plan out your monthly payment for any car loan you may want to get. The first step is to do some research about the different interest rates available and their pros and cons. After determining the interest rates that you think suits you the best, you need to calculate your monthly car loan payments. This can be done in two ways. One way is to visit the website of the lenders that offer such loans and the other way is to use the traditional mortgage calculator.

The mortgage calculator is the more traditional way of computing your monthly car loan payments and it is the most commonly used tool. In this calculator you put in your annual salary, your down payment and the total amount of your auto loan. It will automatically deduct your tax amount from the total amount to come up with your monthly repayment. The results will show you how much interest you will pay overall and how long your auto loan will go toward paying off your debt.

The auto payment calculator is also very useful in planning out your monthly finances. You can easily see how much you will save if you choose a different vehicle, trade in your current car or just trade in your old car altogether. This is especially true if you have an old vehicle that still has a few kilometers on it. By using an auto loan calculator you can see how much money you will save and what your monthly payment would look like if you traded in your car.

A monthly car loan calculator can be very useful as well if you want to get an idea of how much interest you will be paying over the life of your loan. If you have a fairly good understanding of interest rates, you can plug in your starting price of your new car, your monthly payments and your total estimated time before your car is paid off to calculate your interest savings. This can be very helpful in planning out your budget for the long term. If you find that you will have a large amount of interest paid off early, this can be used to help you budget for the higher monthly payments.

Using a loan calculator that shows your monthly payments as well as your total interest rates can give you a better idea of what your monthly payments will look like. These calculators can be very useful tools for budgeting, especially for people who know little about interest rates or loan terms. They can make your budgeting easier and more realistic. If you are having trouble making your monthly payments, there is a good chance you will end up overspending and going further into debt.