How to calculate mortgage payments monthly is simple. All you need to do is to gather all your financial information such as annual income, expenses and other bills into one big sheet. You can either do it yourself or get a mortgage calculator. Once you have your financial information ready, all you need to do is to plug in the figures and see how many monthly payments you will have to set aside.

For example, if you have an annual income of $40k, then the mortgage payment you will have to set aside for a monthly basis will be about $25k. The first thing you need to do before you even start to calculate your mortgage payments is to make a list of all your monthly expenses. Once you have listed them all, then you can calculate your monthly expenses in the following ways:

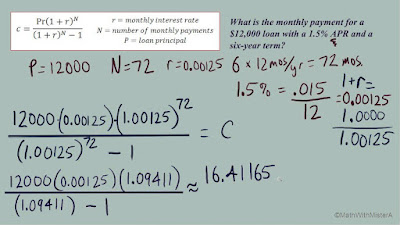

You can use your mortgage calculator to figure out how much you will be spending on your mortgage in interest every month. To do this, all you need to do is to plug in your annual income and your monthly expenses into the mortgage calculator. Once you have all your figures entered, you can see whether your monthly budget can support a mortgage. This is called your capacity to pay.

There are mortgage calculators that you can use online or offline. With online mortgage calculators, you simply need to fill out a simple application form. After a few seconds, you will get the monthly mortgage payments you are expected to pay. Some mortgage calculators also allow you to calculate amortization schedules.

Using a mortgage calculator gives a lot of help when you want to know your monthly budget and plan for future years. Amortization is one method of gradually paying down your mortgage. If you know how long your mortgage will take to be completely paid off, then you can calculate mortgage payments monthly in advance. You can also work out your budget for the next few years.

Mortgage calculators are a great way to calculate mortgage payments monthly. If you have an idea about how much your monthly budget can support, you will not feel so stressed when you are actually buying a house. It is very easy to go into a home purchase without having all the numbers worked out. However, it is important to understand that if you take a mortgage with a bad credit history, then your payments will be higher than if you choose to buy a home with a good credit history. Therefore, you need to factor in your current financial situation when you use a mortgage calculator to make your estimates. The more accurate your estimates are, the better decisions you will make.

Many people prefer to use an online mortgage payment calculator because they do all the math. This way, you can easily figure out what your monthly budget will look like after you have paid all your mortgage, interests, and other expenses for a set amount of time. This allows you to make decisions about spending, whether to buy a big screen HDTV or small refrigerator, and even how much to save each month. A mortgage calculator can help you make better financial decisions by calculating mortgage payments monthly.