Mortgage interest rates have been going down lately, but they can still vary by hundreds of points from the prime rate. For that reason, mortgage rates are used as an early warning system for financial markets. If mortgage rates go up, you don't wait to buy; you move faster. If they drop, it is not a sign to get out of your home just yet. It is wise to act before rates start to drop too far.

To understand daily mortgage rates, you must put the numbers into perspective. If you can only afford a 30-year fixed mortgage at a desired interest rate, then a shorter term loan will be cheaper. You will pay less interest over the life of the loan because you will never have to repay a balloon payment. When comparing short term mortgages to long term mortgages, there are two primary factors to consider: your monthly payment and your monthly savings. A short-term mortgage with a low monthly payment and a high interest rate is a recipe for financial disaster.

The monthly payment is the amount you pay every month for the mortgage, including interest. It does not include your insurance or taxes. It doesn't include any down payment or closing costs. Your goal is to pay as little money as possible over the course of the loan's term. That means finding the lowest monthly payment that you can.

Savings are the difference between your mortgage's cost and what you would pay if you bought a house today with a 30-year fixed mortgage. Savings are important because they reduce the principal balance you will need to borrow to purchase your next home. Lowering the mortgage rates you qualify for will lower your monthly payments and improve your financial situation. In addition, most lenders offer some type of loan insurance. This insurance pays a percentage of your loan if your mortgage goes into default. There is no penalty for purchasing this insurance; however, it must be purchased from your lender.

How you build your savings is entirely up to you. However, you should always make extra payments toward paying off your mortgage early. Paying off your mortgage early reduces the amount of time you will have to pay interest rates. Early payment savings can add up to large monthly payments.

You may also want to consider changing your interest rate. If the current interest rate is higher than you can afford to pay each month, consider switching to a fixed-rate mortgage. This will help you budget for your future payments by keeping your monthly payment constant. This is the best way to avoid rising mortgage interest rates. It is important to remember to cancel your open credit card accounts so they do not contribute to your mortgage.

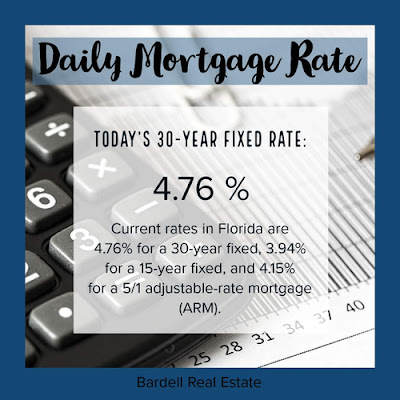

Adjustable mortgage rate tables are very useful tools when shopping for your next mortgage. It is important to remember that your interest rate is only one of several factors considered by lenders. You will need to make several other important decisions regarding your mortgage. Be sure to compare different interest rates and different mortgage terms. Choosing a good interest rate will help you keep more of your money every month.