People have various reasons to borrow money. Some borrow money just to cater for an emergency such as paying off a pending bill or buying a laptop or a car. Many lenders give loans on the basis of your employment. The type of loan you take depends upon the purpose for which you want to borrow the loan.

There are various types of unsecured loans available in the market from various lenders including commercial lenders, private lenders and credit card debt consolidation companies. Sometimes, the most convenient way to borrow money is to apply for personal loans through lenders who specialize in this field. These companies offer loans at convenient interest rates with manageable repayment terms. Some lenders even offer loans at zero percent interest if the borrowers have a good credit score.

In order to get competitive interest rates, it is essential that you do a thorough research about all the different kinds of loans available. This way, you will find out which lender is offering loans at the lowest interest rates. Most of the time, individuals try to consolidate their debts rather than paying off their individual loans because paying them off reduces the amount of money they have to repay each month. However, some of them fail to remember that the total interest rate of all the debts they have to pay off will also come down.

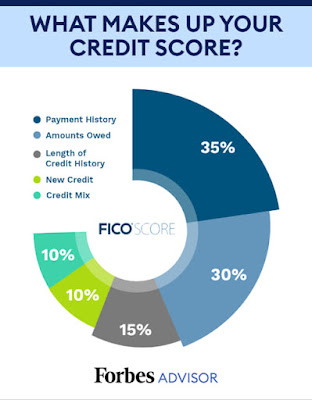

One important factor that determines your interest rate is your credit score. A bad credit score could result in you paying higher interest rate on your loan because you are seen as a greater risk than others. The reason for this is that loans taken by people with bad credit may not always be fully paid back. If you want to avoid paying high interest rate on your loans, you can make a plan and stick to it. You should make your payment plan more flexible so that you can adjust the terms of your loan to meet your current circumstances.

Loans taken by people with average credit score usually have lower interest rates because average credit score borrowers generally spend a short duration to repay the loans. Therefore, there is less chance for lenders to earn profit from these loans because their loans get settled quickly. Lenders also charge lesser fees and other charges on average credit score loans. This means that you pay a lower interest rate on loans taken by people with average credit score.

To take advantage of the lower interest rate, you can get loans with flexible repayment plan and terms. You should choose loans with flexible repayment plan, so that you can spread the cost over a longer duration. Also, if you have bad credit, you should consider getting secured loans. Some lenders offer guaranteed cash loans for people with bad credit. With secured loans, you need to deposit an amount equivalent to the value of the loan into an account provided by the lender.

Another option for you if you have a low credit score is to go for unsecured personal loans. These loans do not require you to put up any collateral or to offer any guarantee to the lender. They also come with a higher interest rate and with a shorter repayment term.