The main advantage of payday loans is that they are a quick and convenient source of cash. They are also flexible in terms of repayment terms so that the lender can decide when they would like the borrower to repay. In the most extreme cases, the borrowed money could be a few hundred dollars, but that is the exception rather than the rule. Most borrowers will not borrow that much in any one month.

However, they do have high rates of interest and charges to compensate them for the convenience and speed of lending. Although many borrowers have low credit scores, this does not mean that they cannot take out payday loans. The rules have been eased in order to encourage more responsible borrowing and reduce the risk to lenders. This may well be the last straw that breaks the camel's back.

There are many situations where payday loans are the right option for desperate borrowers. For example, the borrower may be caught without an income to pay their mortgage in late autumn or winter. This leaves them with no other choice but to declare bankruptcy and end up behind on their property. In order to prevent this, they take out a short-term unsecured loan in order to have the necessary cash on hand to prevent foreclosure. If they do not repay, then they risk losing their home.

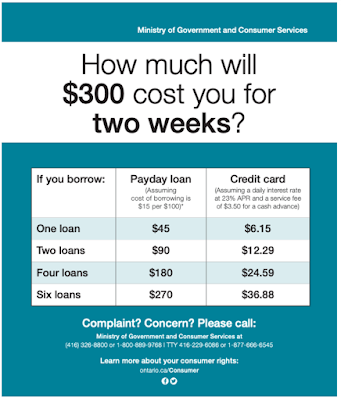

Another good reason to avoid payday loans is the high interest rate charged by loan lenders. The average borrower borrows up to twelve hundred dollars, which works out at around nine hundred percent interest. When added up over a year, this comes out to about seven thousand percent. This is an outrageously high rate of interest that makes borrowing very expensive.

Payday loan lenders also charge extremely high personal loan interest rates as well. This makes borrowing very expensive for people with low credit scores. When combined with high interest rates, payday loans are a very expensive way of getting short-term money when borrowers need it the most. However, borrowers can still get short-term loans despite having very poor credit scores by using different types of personal loan alternative such as personal loans, credit cards, store cards, and mortgages.

The other option that borrowers can use to get short-term cash loans despite their poor credit scores is opening up a savings account. However, since this involves pledging a large sum of money as collateral, it is best used for major emergencies. Other than having to pledge the money in the bank, borrowers must also have a job and be earning a regular income. If the situation arises when the bank cannot provide short-term cash loans, the borrower may be faced with a hardship situation until their next pay check comes. Although this may seem like a better alternative, because of the huge amount of money involved, it is best to use payday loans only when absolutely necessary.

If the above reasons do not sound right to you, there are still other alternatives that you can use to borrow money. The easiest way to borrow money when you have bad credit scores is to open up a savings account under your name that is separate from your name. To get approved by your bank, you will need to provide collateral such as a savings account or a home equity loan. Borrowing this type of money when you have a bad credit history will require a lender with higher interest rates and stricter requirements.