But for those who use mobile devices, having your bank on your phone is even more convenient. Why not? With a merchant account (or eCheck), a customer can go to any ATM and withdraw cash from ATMs of participating banks. This option saves time and paper, and customers no longer have to go to every single bank to get cash. And when a customer goes online to search for a product or look for gas, he doesn't need to go to the gas station or bank and provide identification. He simply performs a transaction at one of the participating sites and gets his cash instantly.

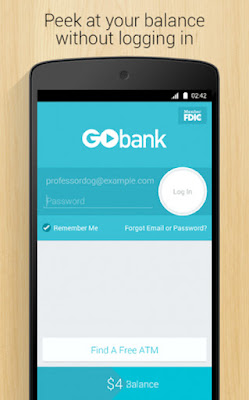

Many consumers think that these apps are expensive, but the reality is quite different. Most banks now offer mobile apps free to their customers. Some are free with a limited number of ATM transactions and overdraft fees. And some even give their customers the ability to set up direct deposit, which means they can make money deposit directly into their bank account.

Consumers should go to banking with the intention of accessing their account through any device they feel comfortable using. The first step is signing up for an account. Once you've done that, you'll gain access to everything your bank offers, whether it's an eCheck e Wallet or an App for your phone.

You'll also need to have a phone and internet connection. And you'll need to be able to pay bills online by using your debit card. If your bank doesn't offer one of these, you'll need to visit your own bank.

Check out the Paypal app. It allows you to pay all those expenses you don't normally have to pay such as taxes, electricity, car repairs and groceries. It is fast and easy and you don't need to carry around lots of cash.

If you don't have an eStuff account, the app is free and super easy to use. All you do is choose your account type, your bank and your paycheck amount. You'll then be asked to select a payment method, which will be linked to your bank account. That's all there is to it! And if you're worried about being able to go online, you don't have to worry anymore.

You don't have to go to a branch and you don't have to go to a payday loan store. You'll be able to complete all these tasks from your iPhone or iPad. You can even pay bills and check your money instantly from wherever you are. No wonder more people are taking advantage of these apps.

Once you download your app, you'll have access to everything that matters to you at your fingertips. You can monitor your finances, make payments and request for statements or invoices through the app. Invoices and statements can be printed out directly from your bank's website. For those who want to go further, there are many apps available today that will give you more features and better options when it comes to banking.

As mentioned earlier, you can go online and access your data from anywhere. You no longer need to bring your laptop or desktop in your office or home. When you travel, you can still get your work done while on the go. You can also check your bank balance or any of your other financial records just by going online.

If you think you'll someday need a bigger bank, you can download a mobile version of your current bank site. The app will allow you to do everything that your regular site provides but will allow you to use all the functions on your phone. For example, you can transfer funds to and from bank accounts, check your bank balance, add a debit card, and more. You'll be able to do these things from any device, and you'll save money in the process. The bottom line is that you don't have to limit yourself anymore with your banking needs, thanks to technology.