It is not that simple though. You have to know what is needed in a policy before you can purchase one. When it comes to the basics, there are three main areas of consideration. The premium, the death benefit, and the investment value. Knowing these things will help you decide on the right type of life insurance for you.

The premium that you will pay for your insurance policies depends on a lot of factors. This is what will determine how do life insurance policies work. Some of these factors include age, gender, health, lifestyle, and the amount of the coverage that you require.

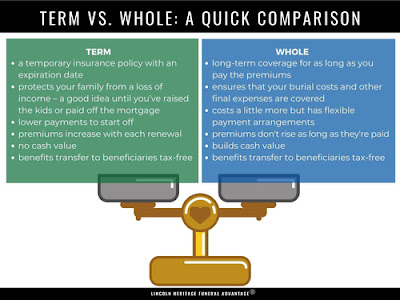

When you look at the different types of policies, you will find that the only basic policy that will cover the entire family is the term life. Term life policies are not really expensive, and they give you a chance to buy coverage over an extended period. If you don't want to be locked into long term coverage, you can choose another type of policy with an investment option or savings. However, if you are looking for coverage for a younger person, a basic policy will probably be the best choice.

After all, no one wants to think about dying early. So, if you can afford a good policy that has a low premium, you might want to go ahead and purchase that policy. Then, when someone young dies, you will have some money to leave to your heirs. It is important to remember that if you cancel your policy, the premiums are due. So, if you don't have the cash on hand, you might have to go without life insurance for a little while.

If you purchase a policy with a cash value, you should always keep in mind that you will only receive the death benefit if the policy is paid out. If you cancel your policy, you lose the cash value. If you don't want to lose the cash value, consider getting a policy that has a variable premium. This is the type of policy where the premiums are affected by factors such as life changes, such as layoffs or other events, as well as current interest rates. With this type of policy, you can expect the premiums to be more in line with current market trends.

As you can see, knowing how do life insurance policies work is very important for those people that have been thinking about purchasing insurance. This is especially true if you are younger than 65 years old. If you think that this might be something that is right for you, talk to a qualified insurance agent today!

Some types of life insurance include term, permanent, and whole life insurance. The most popular is whole life insurance, which pays out regardless of whether the insured dies during the policy or beforehand. In other words, even if you are not alive when the coverage pays out, your beneficiaries will get the proceeds. This policy has a lower monthly premium, but it does not have any cash value. This is one of the cheapest ways to get life insurance coverage.

Term insurance provides protection for a stated time period. The premiums will increase every year, and they will never decrease. This type of coverage is less expensive than some others, but the truth is that you can end up paying thousands of dollars in extra premiums over your lifetime. You pay the premiums even though you might not need to, and you might not be aware that you could be at risk of dying before the policy ends. For this reason, this type of insurance is not a good choice for young families who have young children.

Permanent life insurance policies last for the lifetime of the policyholder, as well as the life of the first beneficiary (if there is one) designated in the policy. This is a good option for older people who want to have an insurance policy that covers them for all of their lives. These policies often have high premiums, because they are guaranteed to pay out, but they are also guaranteed to be around for many years. These policies must be taken out as a permanent policy, and you cannot convert them into term life insurance. There are ways around these restrictions, however, and knowing how do life insurance policies work is essential.